61.6K

Downloads

314

Episodes

Join Renaud Anjoran, Founder & CEO of Sofeast, in this podcast aimed at importers who develop their own products as he discusses the hottest topics and shares actionable tips for manufacturing in China & Asia today!

WHO IS RENAUD?

Renaud is a French ISO 9001 & 14001 certified lead auditor, ASQ certified Quality Engineer and Quality Manager who has been working in the Chinese manufacturing industry since 2005. He is the founder of the Sofeast group that has over 200 staff globally and offers services (QA, product development & engineering, project management, Supply Chain Management, product compliance, reliability testing), contract manufacturing, and 3PL fulfillment for importers and businesses who develop their own products and buyers from China & SE Asia.

WHY LISTEN?

We‘ll discuss interesting topics for anyone who develops and sources their products from Asian suppliers and will share Renaud‘s decades of manufacturing experience, as well as inviting guests from the industry to get a different viewpoint. Our goal is to help you get better results and end up with suppliers and products that exceed your expectations!

Join Renaud Anjoran, Founder & CEO of Sofeast, in this podcast aimed at importers who develop their own products as he discusses the hottest topics and shares actionable tips for manufacturing in China & Asia today!

WHO IS RENAUD?

Renaud is a French ISO 9001 & 14001 certified lead auditor, ASQ certified Quality Engineer and Quality Manager who has been working in the Chinese manufacturing industry since 2005. He is the founder of the Sofeast group that has over 200 staff globally and offers services (QA, product development & engineering, project management, Supply Chain Management, product compliance, reliability testing), contract manufacturing, and 3PL fulfillment for importers and businesses who develop their own products and buyers from China & SE Asia.

WHY LISTEN?

We‘ll discuss interesting topics for anyone who develops and sources their products from Asian suppliers and will share Renaud‘s decades of manufacturing experience, as well as inviting guests from the industry to get a different viewpoint. Our goal is to help you get better results and end up with suppliers and products that exceed your expectations!

Episodes

Friday Apr 29, 2022

Levels of Quality Standards (from Basic to Advanced)

Friday Apr 29, 2022

Friday Apr 29, 2022

In this episode...

In order for your manufacturer to truly understand what you expect from them a quality standard for your product is required. This lays out how the product should look, its components and materials, what defects are and aren't acceptable (if any), its color, and so many other important aspects that Renaud will go into here.

There are different levels of quality standards, from most basic to advanced...you'll see how they all fit together to keep everyone aligned and reduce quality problems from the start of your cooperation with the supplier.

Show Sections

00:00 - Greetings & Introduction

01:03 - What are quality standards?

07:51 - Does every importer implement a clear standard?

10:41 - 1. The golden sample.

16:20 - 2. Specifications sheet.

27:13 - 3. Defect board.

29:23 - 4. Boundary samples.

34:37 - How to handle and keep physical samples safe?

38:19 - Avoiding different conclusions being drawn during inspections by confirming the measurement system to be used, etc.

41:57 - Wrapping up.

Related content...

- Product specifications template for importers in China [FREE download]

- Documenting Your Company’s Quality Standard into the Details

- Is your China factory’s quality standard too low?

- Golden Sample: Why You Need It Before Mass Production Starts

- Why Is A Pre-Production Sample So Important? [Podcast]

- Quality Control Plan: Defining Expectations Before Production

- Product quality inspections in China/Asia [solutions from Sofeast]

Get in touch with us

- Connect with us on LinkedIn

- Send us a tweet @sofeast

- Prefer Facebook? Check us out on FB

- Contact us via Sofeast's contact page

- Subscribe to our YouTube channel

Subscribe to the podcast

There are more episodes to come, so remember to subscribe! You can do so in your favorite podcast apps here and don't forget to give us a 5-star rating, please:

- Apple Podcasts

- Spotify

- Stitcher

- Google Podcasts

- TuneIn

- Amazon Podcasts

- Deezer

- iHeartRADIO

- PlayerFM

- Listen Notes

- Podcast Addict

Get in touch with us

-

- Connect with us on LinkedIn

- Contact us via Sofeast's contact page

- Subscribe to our YouTube channel

- Prefer Facebook? Check us out on FB

Friday Apr 22, 2022

What Happens If You Decide To Leave Your Chinese Supplier?

Friday Apr 22, 2022

Friday Apr 22, 2022

In this episode...

A few episodes ago we put a call out to listeners for questions about manufacturing, especially in China, that they'd like Sofeast's CEO Renaud Anjoran to answer.

One particularly good question that would require too long an answer for just one section of an episode was:

What checklist of activities does an importer need to perform when ending business relationships with a Chinese contract manufacturer?

So, in this episode, Renaud takes you through what happens if you decide to leave your Chinese supplier, including reasons why you'd need to, how to manage the process, and some of the typical actions that need to be taken (in a kind of checklist).

Show Sections

00:00 - Greetings & Introduction

01:47 - Why can starting the process to leave your Chinese supplier be tricky?

06:29 - Reasons why you might decide to leave a supplier.

19:49 - Why the difficulty of doing business with Chinese suppliers these days may force some businesses to move away from even good suppliers.

21:26 - How to manage the process of moving production out of one factory in China to another?

27:31 - How to onboard your new manufacturer?

30:09 - What to do about your tooling?

36:21 - Lying to a supplier to ease a move. Yes, or no?

38:39 - What activities should we plan to do when transferring production from one supplier to a new one?

40:57 - Wrapping up.

Related content...

- 7 Reasons To Switch To A New Chinese Manufacturer

- Tips to Manage the Transfer of Production To Another Chinese Factory

- How To Plan for Transferring Production To a New Factory: 45 Point Checklist

- Get help to find a good manufacturer in China with this free eBook

- When a relationship turns sour with a Chinese supplier

- How To Switch To A Newer, Better Chinese Manufacturer? [eBook]

Get in touch with us

- Connect with us on LinkedIn

- Send us a tweet @sofeast

- Prefer Facebook? Check us out on FB

- Contact us via Sofeast's contact page

- Subscribe to our YouTube channel

Subscribe to the podcast

There are more episodes to come, so remember to subscribe! You can do so in your favorite podcast apps here and don't forget to give us a 5-star rating, please:

- Apple Podcasts

- Spotify

- Stitcher

- Google Podcasts

- TuneIn

- Amazon Podcasts

- Deezer

- iHeartRADIO

- PlayerFM

- Listen Notes

- Podcast Addict

Get in touch with us

-

- Connect with us on LinkedIn

- Contact us via Sofeast's contact page

- Subscribe to our YouTube channel

- Prefer Facebook? Check us out on FB

Friday Apr 15, 2022

How to develop your Chinese suppliers? - Sourcing from China (Part 7)

Friday Apr 15, 2022

Friday Apr 15, 2022

In this episode...

Many importers are new to sourcing from China so we've been creating a mini-series of episodes that explores the sourcing process with advice and best practices from Sofeast's CEO Renaud Anjoran.

In this series of episodes, we’re exploring how to do your own sourcing from China, from finding suppliers for your products to getting them made.

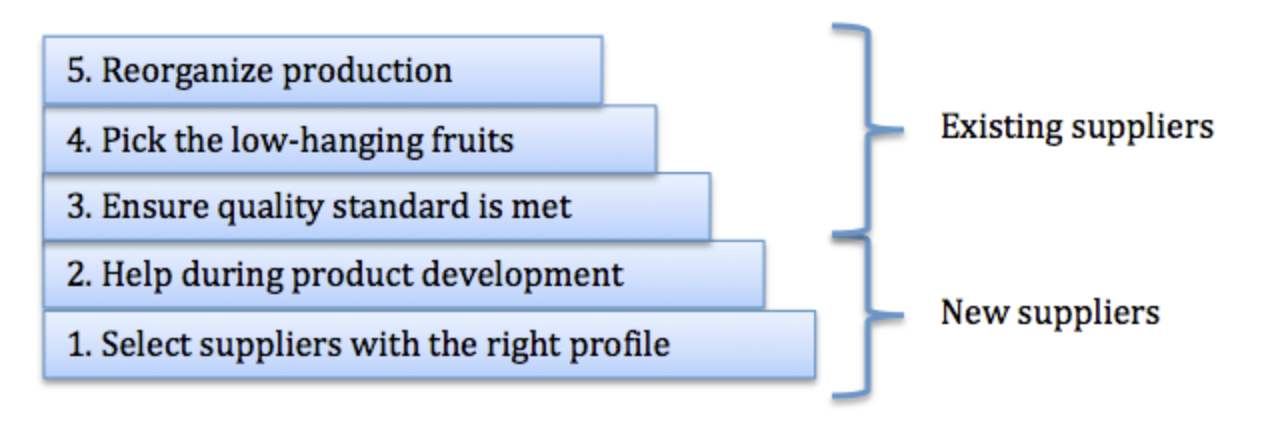

Last time in episode 98 we discussed how to follow up on ongoing production and what it means to be a hands-on or hands-off buyer, and continuing on with soft skills like this we’re now at the point where we’re working with a supplier who’s doing our manufacturing for us in China (or elsewhere in Asia), and the question is: how to develop them for better performance and results, and what sort of results should we be aiming for? This is where implementing a development program comes into it!

Show Sections

00:00 - Greetings & Introduction

02:20 - What is supplier development and is it overlooked by buyers?

Next, we'll go into what a supplier development program includes:

08:36 - 1. Selecting suppliers with the right profile.

12:43 - 2. Helping the supplier during product development and new productions.

17:09 - How phases 1 & 2 are connected to being a hands-on buyer and building rapport with the supplier.

18:44 - 3. Ensure your quality standard is met.

27:34 - Proactive approaches. 4. Targeting low-hanging fruits (small projects for quick wins).

33:05 - 5. Reorganizing manufacturing and/or supply chain processes.

38:51 - Summarizing what a supplier development plan is.

40:46 - When is supplier development worthwhile over switching suppliers and starting again?

41:45 - Why we started our own contract manufacturing subsidiary to embody the best practices discussed here.

43:21 - Wrapping up.

Related content...

- Part 1: Good Fit, Sourcing, Vetting, & Backups [Podcast]

- Part 2: Negotiations, Terms, Leverage, & Quality Standards [Podcast]

- Part 3: Project Management & Checking Quality Early [Podcast]

- Part 4: Final Inspections [Podcast]

- Part 5: Building Rapport [Podcast]

- Part 6: Hands-on or hands-off buyer? [Podcast]

- Developing a Chinese Supplier

- The Sofeast group's own contract manufacturing subsidiary: Agilian Technology

These resources will also help you understand how to build relationships with suppliers or improve (or end) those that you already have:

- Get help to find a good manufacturer in China with this free eBook

- When a relationship turns sour with a Chinese supplier

And, if all else fails and you need to ditch your current supplier and switch to a new one...

Get in touch with us

- Connect with us on LinkedIn

- Send us a tweet @sofeast

- Prefer Facebook? Check us out on FB

- Contact us via Sofeast's contact page

- Subscribe to our YouTube channel

Subscribe to the podcast

There are more episodes to come, so remember to subscribe! You can do so in your favorite podcast apps here and don't forget to give us a 5-star rating, please:

- Apple Podcasts

- Spotify

- Stitcher

- Google Podcasts

- TuneIn

- Amazon Podcasts

- Deezer

- iHeartRADIO

- PlayerFM

- Listen Notes

- Podcast Addict

Get in touch with us

-

- Connect with us on LinkedIn

- Contact us via Sofeast's contact page

- Subscribe to our YouTube channel

- Prefer Facebook? Check us out on FB

Friday Apr 08, 2022

How To Set Up A Receiving Quality Inspection?

Friday Apr 08, 2022

Friday Apr 08, 2022

In this episode...

Sofeast's CEO Renaud Anjoran is joined by Adrian from the team to explain how to set up a receiving quality inspection on incoming components or materials that will be used by your factory or manufacturer to produce your products.

We've all heard the saying: "Garbage in, garbage out." This principle applies to manufacturing. So by conducting a receiving quality inspection, we assure that the components going into our products reach our expectations and reduce the chances of quality and reliability issues occurring in the finished products.

Keep listening to understand what the inspection is and how to set it up...

Show Sections

00:00 - Greetings and introduction.

01:02 - Covid in China.

06:28 - What is a receiving quality inspection?

14:11 - Benefits a receiving inspection provides.

16:16 - Some observations about why receiving inspections are needed.

19:22 - How a receiving inspection is made up (5 parts).

21:55 - 1. How to define receiving inspection requirements?

23:59 - 2. How to focus on the most important criteria (most critical parts and the highest risk)?

26:39 - 3. What incoming inspection procedure to follow?

31:13 - 4. How to report the findings?

33:08 - 5. How to drive improvement in the supplier base?

35:41 - Wrapping up.

Related content...

- Product Inspection Solutions In China & Asia (from Sofeast)

- How A Material Review Board (MRB) Works & Why YOUR Factory Needs One

- How to set up a Receiving Inspection: Checklist, Procedure, Reporting form

- Use a Corrective Action Plan after a Failed Inspection

Get in touch with us

- Connect with us on LinkedIn

- Send us a tweet @sofeast

- Prefer Facebook? Check us out on FB

- Contact us via Sofeast's contact page

- Subscribe to our YouTube channel

Subscribe to the podcast

There are more episodes to come, so remember to subscribe! You can do so in your favorite podcast apps here and don't forget to give us a 5-star rating, please:

- Apple Podcasts

- Spotify

- Stitcher

- Google Podcasts

- TuneIn

- Amazon Podcasts

- Deezer

- iHeartRADIO

- PlayerFM

- Listen Notes

- Podcast Addict

Get in touch with us

-

- Connect with us on LinkedIn

- Contact us via Sofeast's contact page

- Subscribe to our YouTube channel

- Prefer Facebook? Check us out on FB

Friday Apr 01, 2022

100th episode special: YOUR manufacturing questions answered!

Friday Apr 01, 2022

Friday Apr 01, 2022

In this episode...

To celebrate our 100th episode Sofeast's CEO Renaud Anjoran takes questions from our listeners and answers as many as possible in this special episode.

100 episodes is an important milestone and we're so glad that listeners enjoy the podcast and find it helpful, so thanks for the kind comments in your emails!

Show Sections

00:00 - Greetings and introduction.

01:50 - Should importers be worried about Chinese supply chains in relation to the Russian invasion and its sanctions?

06:56 - What inspection level is needed for medical devices? (AQL limits).

10:19 - How to improve the quality of products being purchased from China? The bikes and office furniture we buy keep breaking!

18:13 - Any tactics to deal with volatile costs these days?

25:02 - How to work with Chinese suppliers without being ripped off?

30:10 - How can I be sure that the product quality is as expected if I'm not in China to supervise the order myself?

38:34 - Wrapping up.

Related content...

- The Impacts of Russia Sanctions on International Trade & Logistics

- What is the AQL (Acceptance Quality Limit)? An exhaustive guide

- Manufacturing Contract: Fear And Its Impact On Payment Terms

- Factory audits

- Product inspections

Get in touch with us

- Connect with us on LinkedIn

- Send us a tweet @sofeast

- Prefer Facebook? Check us out on FB

- Contact us via Sofeast's contact page

- Subscribe to our YouTube channel

Subscribe to the podcast

There are more episodes to come, so remember to subscribe! You can do so in your favorite podcast apps here and don't forget to give us a 5-star rating, please:

- Apple Podcasts

- Spotify

- Stitcher

- Google Podcasts

- TuneIn

- Amazon Podcasts

- Deezer

- iHeartRADIO

- PlayerFM

- Listen Notes

- Podcast Addict

Get in touch with us

-

- Connect with us on LinkedIn

- Contact us via Sofeast's contact page

- Subscribe to our YouTube channel

- Prefer Facebook? Check us out on FB

Friday Mar 25, 2022

Friday Mar 25, 2022

In this episode...

Sofeast's CEO Renaud Anjoran is joined once again by our reliability expert, Andrew Amirnovin, and this time they're giving an overview of 12 things that a company can optimize for when designing and developing a new product. These include 'Design for Manufacturing,' Design for Assembly,' and many more. So, what are the DfX principles, what are their benefits if adopted by designers, and which could be right for you to focus on? Keep listening...

Show Sections

00:00 - Greetings and introducing the topic of DfX.

02:30 - 1. Design for Short Development & Time to Market.

05:16 - 2. Design for Crowdfunding.

08:13 - 3. Design for Manufacturing (DFM).

10:29 - 4. Design for Assembly (DFA).

13:35 - DFM & DFA tips for product designers to keep in mind.

19:19 - The rise of modularization.

25:04 - 5. Design for Quality & 6. Design for Testing

32:37 - 7. Design for Packaging.

35:45 - 8. Design for Reliability

45:12 - 9. Design for Maintainability.

49:15 - 10. Design for Ease of use/Ergonomics.

49:35 - 11. Design for Fewer SKUs.

50:20 - 12. Design for Sustainability.

51:02 - Which DfX principles are crucial?

51:55 - How to implement DfX?

53:58 - Wrapping up.

Related content...

- The Design for X Approach: 12 Common Examples

- Design for Distribution (DFD)

- Design to Cost (DTC)

- Design for Manufacturing (DFM)

- Design for Quality (DFQ)

- Design For Sustainability

- Design For Crowdfunding (Kickstarter & Indiegogo)

- Design For Assembly (DFA)

- Design for Distribution: What Hardware Startups Need To Know

Get in touch with us

- Connect with us on LinkedIn

- Send us a tweet @sofeast

- Prefer Facebook? Check us out on FB

- Contact us via Sofeast's contact page

- Subscribe to our YouTube channel

Subscribe to the podcast

There are more episodes to come, so remember to subscribe! You can do so in your favorite podcast apps here and don't forget to give us a 5-star rating, please:

- Apple Podcasts

- Spotify

- Stitcher

- Google Podcasts

- TuneIn

- Amazon Podcasts

- Deezer

- iHeartRADIO

- PlayerFM

- Listen Notes

- Podcast Addict

Get in touch with us

-

- Connect with us on LinkedIn

- Contact us via Sofeast's contact page

- Subscribe to our YouTube channel

- Prefer Facebook? Check us out on FB

Friday Mar 18, 2022

‘Hands-On’ Or ‘Hands-Off’ Buyer? - Sourcing from China (Part 6)

Friday Mar 18, 2022

Friday Mar 18, 2022

In this episode...

Many importers are new to sourcing from China so we've been creating a mini-series of episodes that explores the sourcing process with advice and best practices from Sofeast's CEO Renaud Anjoran.

In this series of episodes, we’re exploring how to do your own sourcing from China, from finding suppliers for your products to getting them made.

We’ve moved onto soft skills, and last time in episode 92 we spoke about building rapport with your suppliers. Now, we’re going to look at how closely to follow production - either closely as a hands-on buyer, or with more distance as a hands-off buyer. Either approach might benefit you, but it depends on a number of factors, such as product type, the volume of SKUs being purchased, whether or not you're developing a new product from scratch, and more.

Listen and decide if you'd be better served by being more hands-on or hands-off.

Show Sections

00:00 - Greetings & quick mention of Covid in China

01:42 - Introducing the topic: How closely to follow production?

02:41 - What is a hands-off buyer?

08:33 - Buyers who should be more hands-on, but aren't, and the risks they face

11:29 - What is the typical sourcing process for hands-off buyers?

17:59 - What is a hands-on buyer?

23:32 - Benefits of being hands-on.

30:06 - Is there a risk of the supplier taking advantage of long-term customers who're reliant on them?

35:10 - Wrapping up.

Related content...

- Part 1: Good Fit, Sourcing, Vetting, & Backups [Podcast]

- Part 2: Negotiations, Terms, Leverage, & Quality Standards [Podcast]

- Part 3: Project Management & Checking Quality Early [Podcast]

- Part 4: Final Inspections [Podcast]

- Part 5: Building Rapport [Podcast]

- New Importer from China? Beware the Credulous Foreigner Syndrome!

These resources will also help you understand how to build relationships with suppliers or improve (or end) those that you already have:

- Get help to find a good manufacturer in China with this free eBook

- When a relationship turns sour with a Chinese supplier

And, if all else fails and you need to ditch your current supplier and switch to a new one...

Get in touch with us

- Connect with us on LinkedIn

- Send us a tweet @sofeast

- Prefer Facebook? Check us out on FB

- Contact us via Sofeast's contact page

- Subscribe to our YouTube channel

Subscribe to the podcast

There are more episodes to come, so remember to subscribe! You can do so in your favorite podcast apps here and don't forget to give us a 5-star rating, please:

- Apple Podcasts

- Spotify

- Stitcher

- Google Podcasts

- TuneIn

- Amazon Podcasts

- Deezer

- iHeartRADIO

- PlayerFM

- Listen Notes

- Podcast Addict

Get in touch with us

-

- Connect with us on LinkedIn

- Contact us via Sofeast's contact page

- Subscribe to our YouTube channel

- Prefer Facebook? Check us out on FB

Monday Mar 14, 2022

BONUS: Covid Lockdowns Intensify Across China

Monday Mar 14, 2022

Monday Mar 14, 2022

In this episode...

Renaud is back with a bonus episode about the Covid situation in China. Since our last episode, the situation has gotten a lot more serious and there are lockdowns all around China, including in some major manufacturing cities and provinces, including Guangdong, Hong Kong, Shanghai, and Changchun (to name but a few).

Until now supply chains probably haven't been affected so much, but now factories are being shuttered, staff are at home, and deliveries and shipments can't take place. Add this to the sanctions on Russia, and times are getting complicated.

Show Sections

00:00 - Introduction.

00:52 - The uncertain situation. Have the figures been accurate?

02:05 - Shenzhen has been locked down, here's what we know.

04:28 - Focus on South China (including Hong Kong)

08:08 - Can the government contain the outbreaks and what's the impact on manufacturing?

14:14 - Other areas and cities around China's North facing restrictions.

16:06 - How these lockdowns will impact importers, especially logistics.

21:34 - Ports in China and shipping are at particular risk of disruption by Covid cases.

22:37 - Wrapping up.

Related content...

Here are some related posts:

- The Impacts of Russia Sanctions on International Trade & Logistics

- China Massive Lockdowns (March 22): The Domino Effect In Full Force

- Supply Chain Risk Reduction Strategies [Presentation]

- How Blending Off-site & On-site QA Activities Helps You Reach Your Objectives

Get in touch with us

- Connect with us on LinkedIn

- Send us a tweet @sofeast

- Prefer Facebook? Check us out on FB

- Contact us via Sofeast's contact page

- Subscribe to our YouTube channel

Subscribe to the podcast

There are more episodes to come, so remember to subscribe! You can do so in your favorite podcast apps here and don't forget to give us a 5-star rating, please:

- Apple Podcasts

- Spotify

- Stitcher

- Google Podcasts

- TuneIn

- Amazon Podcasts

- Deezer

- iHeartRADIO

- PlayerFM

- Listen Notes

- Podcast Addict

Get in touch with us

-

- Connect with us on LinkedIn

- Contact us via Sofeast's contact page

- Subscribe to our YouTube channel

- Prefer Facebook? Check us out on FB

Friday Mar 11, 2022

What’s The ’Cradle To Cradle’ Product Design Concept?

Friday Mar 11, 2022

Friday Mar 11, 2022

In this episode...

Renaud and Adrian are back to discuss 'Cradle to Cradle' product design. Sustainability is in the media a lot these days as we have global instability from Covid and war causing energy, material, and shipping cost increases (among others) and climate change and environmental damage becoming more serious leading to the need to reduce carbon emissions as well as lowering the amount of hazardous waste produced.

So, traditional products that become waste at the end of their lifecycles are starting to be replaced by more sustainable ones, and one of the most sustainable product design concepts is C2C that, theoretically, stops products from becoming waste at all.

Sit back and listen as we discuss the history of manufacturing, how it has evolved to become 'less bad' in the late 20th Century and now more sustainable in the early 21st, what's included in C2C certification, how to design Cradle to Cradle products, and the pros & cons of following this approach.

However, as the Covid situation in China becomes more serious, we start by checking in on how this could be affecting supply chains and the situation on the ground there...

Show Sections

00:00 - Greetings & introduction to the topic.

01:47 - The Covid situation in China and Hong kong.

07:45 - How we got from unsustainable (take/make/waste) to more sustainable (cradle to grave) manufacturing.

15:08 - The move to fully sustainable (cradle to cradle) manufacturing due to the failure of recycling to be sustainable.

20:22 - Key features of the C2C ethos.

25:18 - How much can manufacturers do to increase their use of renewable energy?

27:20 - C2C certification.

33:54 - C2C product examples.

36:55 - What do product designers need to keep in mind when designing a C2C product?

41:15 - Benefits of C2C.

44:55 - Drawbacks of C2C.

49:16 - How Sofeast can help your businesses become more sustainable.

53:22 - Wrapping up.

Related content...

Here are some related posts:

- 15 Key Eco Certifications For Green Manufacturers

- Minimizing a Product’s ‘Cradle to Grave’ Environmental Impact

- Designing New Products With A Cradle To Cradle Cycle In Mind

- Sofeast Oil Based Plastic Alternatives whitepaper

- The Benefits Of Silicone As A Production Material And How It Compares To Common Plastics

- What Items Are Recyclable?

- What does biodegradable mean in the context of manufacturing?

- Sustainable Manufacturing

- What Does ‘Eco-Friendly’ Mean?

- What does compostable mean in relation to manufacturing and packaging materials?

- What Is Recommerce?

- 9 Types of Packaging (Benefits, Costs, Sustainability, and more)

- Advantages of Bioplastics vs. Disadvantages: Memo for Product Designers

- 7 Negative Effects Of PVC And Other Environmentally Harmful Plastics

- How Can Poor Quality & Reliability Products Affect Your Business? [Podcast]

- C2C product certification - official site

Get in touch with us

- Connect with us on LinkedIn

- Send us a tweet @sofeast

- Prefer Facebook? Check us out on FB

- Contact us via Sofeast's contact page

- Subscribe to our YouTube channel

Subscribe to the podcast

There are more episodes to come, so remember to subscribe! You can do so in your favorite podcast apps here and don't forget to give us a 5-star rating, please:

- Apple Podcasts

- Spotify

- Stitcher

- Google Podcasts

- TuneIn

- Amazon Podcasts

- Deezer

- iHeartRADIO

- PlayerFM

- Listen Notes

- Podcast Addict

Get in touch with us

-

- Connect with us on LinkedIn

- Contact us via Sofeast's contact page

- Subscribe to our YouTube channel

- Prefer Facebook? Check us out on FB

Friday Mar 04, 2022

Could War In Ukraine Affect Chinese Supply Chains?

Friday Mar 04, 2022

Friday Mar 04, 2022

In this episode...

Renaud and Adrian speak about the current war in Ukraine as we reach about a week into Russia's invasion. How can large-scale wars like this affect global supply chains? Where does China come into it? Is the West likely to turn its back on China in a similar way as they have done with Russia in the future? Finally, Renaud leaves you with some tips to reduce supply chain risks by potentially not leaving all of your eggs in the China basket.

Show Sections

00:00 - Greetings & introduction.

01:15 - Some thoughts about the war in Ukraine.

04:26 - The speed of Western sanctions against Russia and their effects.

07:57 - Will sanctions on Russia affect China?

10:34 - Logistics costs.

12:28 - Could the decoupling happening to Russia happen to China, too?

17:24 - Is the risk of a sudden decoupling from China higher or lower now?

20:29 - What can be done to reduce supply chain risks in this time of instability?

25:06 - Wrapping up.

Related content...

Here are some related posts:

- Ukrainian invasions adds to chaos for global supply chains

- A Guide to Fast-Moving Russian Sanctions and Export Controls

- You may check up-to-date information on the war in Ukraine on Reuters

- Supply Chain Risk Reduction Strategies [Presentation]

- Supply Chain Risk Management, Part 1: What are VUCA and Black Swans?

- Supply Chain Risk Management, Part 2: The Business Continuity Plan

- Supply Chain Risk Management, Part 3: A Purchaser Supply Chain KPI Scorecard’s Benefits

- Supply Chain Risk Management, Part 4: How Much Inventory Do You Need?

- Supply Chain Risk Management, Part 5: Moving Manufacturing to Vietnam, Thailand, Malaysia, or India (Pros & Cons)

Get in touch with us

- Connect with us on LinkedIn

- Send us a tweet @sofeast

- Prefer Facebook? Check us out on FB

- Contact us via Sofeast's contact page

- Subscribe to our YouTube channel

Subscribe to the podcast

There are more episodes to come, so remember to subscribe! You can do so in your favorite podcast apps here and don't forget to give us a 5-star rating, please:

- Apple Podcasts

- Spotify

- Stitcher

- Google Podcasts

- TuneIn

- Amazon Podcasts

- Deezer

- iHeartRADIO

- PlayerFM

- Listen Notes

- Podcast Addict

Get in touch with us

-

- Connect with us on LinkedIn

- Contact us via Sofeast's contact page

- Subscribe to our YouTube channel

- Prefer Facebook? Check us out on FB