61.1K

Downloads

311

Episodes

Join Renaud Anjoran, Founder & CEO of Sofeast, in this podcast aimed at importers who develop their own products as he discusses the hottest topics and shares actionable tips for manufacturing in China & Asia today!

WHO IS RENAUD?

Renaud is a French ISO 9001 & 14001 certified lead auditor, ASQ certified Quality Engineer and Quality Manager who has been working in the Chinese manufacturing industry since 2005. He is the founder of the Sofeast group that has over 200 staff globally and offers services (QA, product development & engineering, project management, Supply Chain Management, product compliance, reliability testing), contract manufacturing, and 3PL fulfillment for importers and businesses who develop their own products and buyers from China & SE Asia.

WHY LISTEN?

We‘ll discuss interesting topics for anyone who develops and sources their products from Asian suppliers and will share Renaud‘s decades of manufacturing experience, as well as inviting guests from the industry to get a different viewpoint. Our goal is to help you get better results and end up with suppliers and products that exceed your expectations!

Episodes

Friday Sep 17, 2021

Friday Sep 17, 2021

In this episode...

Sofeast's CEO Renaud Anjoran is joined by experienced British product designer Andy Bartlett to discuss the NPI process and product design best practices for new and unique products, and the disconnect between expectations and reality of many entrepreneurs or companies who are inexperienced in developing new products.

Andy brings a product designer's point of view to show and he and Renaud explore some of the most critical product design and development stages, why they're so important, some examples of products that had issues and why, and certain mistakes to avoid for product development rookies.

Show Notes

00:00 - Introduction.

02:11 - What is the disconnect between expectation and reality when developing a new product and why might this happen?

08:36 - Why the early design work is critical as it determines so much of later work in the project.

10:51 - An example of a poorly designed product that negatively affected the whole NPI project.

15:16 - Getting to the answer "NO."

20:03 - The key takeaways about early design work.

21:35 - Getting to prototypes quickly (agile product development).

28:04 - Common mistakes that can cause problems once mass production starts.

36:26 - An example of what happens to you if your product causes injury or death.

38:31 - Benefits of going to market with a Minumum Viable Proposition.

40:20 - Wrapping up

Related content...

- Why New Product Development of Electronics Takes So Long

- Look out for feature creep when developing a new product

- What is agile design when developing a new product?

- Prototyping Process To Test & Refine a New Product Design

- What Are The New Product Development Deliverables? [Podcast]

- Analysing the (NPI) New Product Introduction Process & its Benefits [Podcast]

- Why Pilot Runs Are A 'Must-Do' When Launching New Products [Podcast]

- NPI Process (New Product Introduction)

- The New Product Introduction Process For Hardware Startups [Guide]

- Learn more about the supersonic Concorde airliner

Get in touch with us

- Connect with us on LinkedIn

- Send us a tweet @sofeast

- Prefer Facebook? Check us out on FB

- Contact us via Sofeast's contact page

- Subscribe to our YouTube channel

Subscribe to the podcast

There are more episodes to come, so remember to subscribe! You can do so in your favorite podcast apps here and don't forget to give us a 5-star rating, please:

- Apple Podcasts

- Spotify

- Stitcher

- Google Podcasts

- TuneIn

- Deezer

- iHeartRADIO

- PlayerFM

- Listen Notes

- Podcast Addict

Get in touch with us

-

- Connect with us on LinkedIn

- Contact us via Sofeast's contact page

- Subscribe to our YouTube channel

- Prefer Facebook? Check us out on FB

Friday Sep 10, 2021

What Are The New Product Development Deliverables?

Friday Sep 10, 2021

Friday Sep 10, 2021

In this episode...

Sofeast's CEO Renaud Anjoran is joined by Adrian from the team and they go through what deliverables buyers can expect to receive when working with suppliers during a new product development project in order to get safe, high-quality products into mass production.

If you are developing a new product, you'll get a good grounding into what should be performed and documented during the process from product R&D through to mass production, including design files, the BOM, how to reduce risks, the control plan, inspections, pre-production validation testing, and more.

Show Notes

00:00 - Introduction.

01:03 - Going through the NPD process from the buyer's side and its deliverables in detail.

- 04:06 - The latest version of design files.

- 05:42 - The BOM.

- 07:28 - Risk mitigation.

09:28 - Elements and learnings from the automotive industry (PPAP).

- 10:49 - Risk analysis - FMEA on design & processes.

- 14:28 - The process flow chart/diagram.

- 15:55 - The control plan.

- 19:37 - Calibration or verification certificates of fixtures and instruments for checking quality.

- 21:44 - Product QC inspections.

- 23:31 - Pilot run stage - EVT, DVT, PVT.

- 28:03 - Engineering changes.

- 29:23 - Prototypes/tooling/PP samples.

31:44 - Does every type of part or product require such stringent deliverables?

33:45 - Wrapping up

Related content...

- Analysing the (NPI) New Product Introduction Process & its Benefits [Podcast]

- Why Pilot Runs Are A 'Must-Do' When Launching New Products [Podcast]

- NPI Process (New Product Introduction)

- NPD Project Constraints (3 common examples)

- Why You Need Mature Product Designs BEFORE Working With A Chinese Manufacturer!

- 3 Key Process Improvement Tools You Need To Start Using: Flow Chart, FMEA, Control Plan

- Developing New Products? Which Suppliers Are The Right Fit For You?

- The New Product Introduction Process For Hardware Startups [Guide]

Get in touch with us

- Connect with us on LinkedIn

- Send us a tweet @sofeast

- Prefer Facebook? Check us out on FB

- Contact us via Sofeast's contact page

- Subscribe to our YouTube channel

Subscribe to the podcast

There are more episodes to come, so remember to subscribe! You can do so in your favorite podcast apps here and don't forget to give us a 5-star rating, please:

- Apple Podcasts

- Spotify

- Stitcher

- Google Podcasts

- TuneIn

- Deezer

- iHeartRADIO

- PlayerFM

- Listen Notes

- Podcast Addict

Get in touch with us

-

- Connect with us on LinkedIn

- Contact us via Sofeast's contact page

- Subscribe to our YouTube channel

- Prefer Facebook? Check us out on FB

Friday Sep 03, 2021

Friday Sep 03, 2021

In this episode...

Sofeast CEO Renaud Anjoran talks sourcing with Adrian from the team. There's a focus on sourcing from China for importers who have decided to handle it themselves. This follows on from Episode 65 where we explored the 4 different sourcing options, where 'DIY' was one of them.

So, let's say you're doing your own sourcing, how do you find suitable suppliers, verify them, and cultivate backups for if you have issues? Renaud gives you lots of insight and advice about these early-stage sourcing activities here!

Show Notes

00:00 - Introduction.

02:23 - How to identify 'good fit' suppliers for yourself and why there are no 'good' or 'bad' suppliers out there.

14:25 - A list of sourcing actions to take to find new suppliers. Finding a supplier who can be a reliable partner in the medium or long term is a process.

- 15:13 - Identify what a good fit for your needs is (discussed earlier).

- 19:35 - Start searching for suppliers.

22:00 - Screening or vetting potential suppliers you've found. - 24:07 - Contact the supplier.

29:04 - Get even more help with vetting new Chinese suppliers by listening to our podcast series about it: Vetting new suppliers in China series.

29:40 - If you have found a good fit supplier, is a backup option from your shortlist strictly necessary?

40:01 - Wrapping up

Related content...

- How To Find Trustworthy Suppliers In China In 2021

- OEM, ODM, Contract Manufacturers: Which Chinese Supplier To Choose?

- Are Suppliers We Find On Alibaba.com And GlobalSources.com Trustworthy?

- How To Switch To A Newer, Better Chinese Manufacturer? [eBook]

- New supplier/factory sourcing (get help from Sofeast)

- Supplier due diligence (get help from Sofeast)

Get in touch with us

- Connect with us on LinkedIn

- Send us a tweet @sofeast

- Prefer Facebook? Check us out on FB

- Contact us via Sofeast's contact page

- Subscribe to our YouTube channel

Subscribe to the podcast

There are more episodes to come, so remember to subscribe! You can do so in your favorite podcast apps here and don't forget to give us a 5-star rating, please:

- Apple Podcasts

- Spotify

- Stitcher

- Google Podcasts

- TuneIn

- Deezer

- iHeartRADIO

- PlayerFM

- Listen Notes

- Podcast Addict

Get in touch with us

-

- Connect with us on LinkedIn

- Contact us via Sofeast's contact page

- Subscribe to our YouTube channel

- Prefer Facebook? Check us out on FB

Friday Aug 27, 2021

Friday Aug 27, 2021

In this episode...

Sofeast CEO Renaud Anjoran is joined by two very experienced manufacturing practitioners and consultants to discuss how to push your supplier to move increasingly close to zero defects. Podcast regular Clive Greenwood who is a six sigma black belt and has worked in numerous manufacturing roles and Max Phythian, a pure lean consultant with a long history of working in Toyota, make up the three.

They discuss how to transform your relationship with key suppliers, moving away from a transactional model and becoming a partnership where real progress can be made to reduce defects and improve overall quality in the longer term. You'll hear plenty of real-world examples from their manufacturing careers and learn what holds suppliers back from reducing defects, what buyers need to do to help buyers improve, and much more.

Show Notes

00:00 - Introduction.

02:03 - What does it take to get a key supplier to put in the work to go closer to zero defects?

09:39 - How to create the conditions required for better quality?

18:13 - How to speak with your supplier's top management to spur the effort to go to zero defects?

27:22 - About CoQ (cost of quality). How to change a supplier's mindset that 'better quality will require higher prices?'

33:13 - Since the 80s large organizations like Auto manufacturers improved quality a lot. What caused this (better communication, more awareness of CoQ, better incentives)?

35:38 - How should people in a less-regulated industry, such as general consumer goods, approach their suppliers about reducing defects quickly?

42:38 - Let's say you have a key supplier and their quality isn't improving over the years even though they know your standard. What can be done to push them to improve? Stick or carrot?

47:39 - Wrapping up

Related content...

- Exploring How To Improve Supplier Performance [Podcast]

- Improving Supplier Performance is Buyers’ Biggest Hurdle

- A Good Way To Analyze Data to Drive Process Improvements

- How To Manage Chinese Suppliers based on Facts & Data

- 3 Key Process Improvement Tools You Need To Start Using: Flow Chart, FMEA, Control Plan

- Should You Avoid the Words “Defects” and “Defectives”?

- How many defects are still in a batch after an AQL inspection?

- What should factory operators do when defects are found?

- How To Switch To A Newer, Better Chinese Manufacturer? [eBook]

Get in touch with us

- Connect with us on LinkedIn

- Send us a tweet @sofeast

- Prefer Facebook? Check us out on FB

- Contact us via Sofeast's contact page

- Subscribe to our YouTube channel

Subscribe to the podcast

There are more episodes to come, so remember to subscribe! You can do so in your favorite podcast apps here and don't forget to give us a 5-star rating, please:

- Apple Podcasts

- Spotify

- Stitcher

- Google Podcasts

- TuneIn

- Deezer

- iHeartRADIO

- PlayerFM

- Listen Notes

- Podcast Addict

Get in touch with us

-

- Connect with us on LinkedIn

- Contact us via Sofeast's contact page

- Subscribe to our YouTube channel

- Prefer Facebook? Check us out on FB

Friday Aug 20, 2021

5 Challenges Importers Face When Preparing For 2022

Friday Aug 20, 2021

Friday Aug 20, 2021

In this episode...

Renaud and Adrian discuss 5 of the challenges that lie ahead for importers who need to start preparing for 2022 now in August 2021! We've got Covid-19 and its lockdowns and travel restrictions, the shipping situation with enormously high costs and delays, a shortage of electronic components, and an unfavorable USD/RMB exchange rate.

How could these affect you? Keep listening to find out!

Show Notes

00:00 - Introduction.

02:26 - Summary of the 5 challenges we'll discuss: Covid-19, shipping, electronic component shortages, the USD/RMB exchange rate, and why it's too late to ship for Christmas 2021 now and why importers need to hurry up and ship for CNY.

03:52 - Challenge 1. Time (Shipping in time for Christmas and CNY).

05:55 - Challenge 2. Covid-19 (How Covid is still disrupting manufacturing and importers).

19:46 - Challenge 3. Shipping (crazy high costs and delays).

28:31 - Challenge 4. Shortage of electronic components.

31:30 - Challenge 5. USD/RMB exchange rate.

36:53 - Wrapping up

Related content...

- China’s Factories Are On A Wartime Footing Due To Covid. How Does This Affect You?

- China’s Shipping Bottlenecks June 2021 – What It All Means For You

- Exploring Why Sea Freight Is So Expensive In Summer ’21 [Podcast]

- Lead Time Reduction Strategies [Podcast]

Get in touch with us

- Connect with us on LinkedIn

- Send us a tweet @sofeast

- Prefer Facebook? Check us out on FB

- Contact us via Sofeast's contact page

- Subscribe to our YouTube channel

Subscribe to the podcast

There are more episodes to come, so remember to subscribe! You can do so in your favorite podcast apps here and don't forget to give us a 5-star rating, please:

- Apple Podcasts

- Spotify

- Stitcher

- Google Podcasts

- TuneIn

- Deezer

- iHeartRADIO

- PlayerFM

- Listen Notes

- Podcast Addict

Get in touch with us

-

- Connect with us on LinkedIn

- Contact us via Sofeast's contact page

- Subscribe to our YouTube channel

- Prefer Facebook? Check us out on FB

Friday Aug 13, 2021

Is Mexico A Credible Alternative For Importers From China?

Friday Aug 13, 2021

Friday Aug 13, 2021

In this episode...

Dan Harris from China Law Blog recently wrote: "Mexico is the New China" and Manufacturers are Moving There.

Having read it, Sofeast's CEO Renaud Anjoran and Adrian from the team discuss nearshoring, how credible an alternative to China Mexico is as a location for your manufacturing and some of Mexico's pros & cons. Renaud also gives some guidance on how importers need to assess their supply chains to decide if and where moving some of their manufacturing is beneficial.

Show Notes

00:00 - Introduction.

00:59 - Is Mexico really a credible alternative to China?

03:28 - What is happening in China (and SE Asia) that is driving US companies out to other countries like Mexico?

08:00 - Why Mexico is an obvious choice for some US importers suffering from supply chain risks in Asia.

09:13 - Is moving to Mexico something that would be more suitable for SMEs rather than MNCs?

14:14 - Could nearshoring to somewhere like Mexico be more expensive than having a supply chain in Asia?

18:39 - What benefits does Mexico have?

21:04 - Are many companies truly moving 100% of their manufacturing to Mexico, or is it more of a supplemental location?

25:19 - What are Mexico's drawbacks?

29:47 - Renaud's tips on managing the process of moving some/all manufacturing out of China.

36:14 - Wrapping up

Related content...

- China Law blog's post: "Mexico is the New China" and Manufacturers are Moving There

- Another post from China Law Blog: Using Shelter Companies to Move Manufacturing from China to Mexico

- Renaud wrote about Why Your Product's Final Assembly Should Be Close To Its Key Components on QualityInspection.org.

- Read about How To Diversify Manufacturing Sources Out of China and Cut Risk.

- Listen back to our earlier episode Manufacture in China, Vietnam, India, or Elsewhere in 2021?

- Listen back to our earlier episode A New ‘Cold War’ Between The USA & China’s Effect On Manufacturing.

Get in touch with us

- Connect with us on LinkedIn

- Send us a tweet @sofeast

- Prefer Facebook? Check us out on FB

- Contact us via Sofeast's contact page

- Subscribe to our YouTube channel

Subscribe to the podcast

There are more episodes to come, so remember to subscribe! You can do so in your favorite podcast apps here and don't forget to give us a 5-star rating, please:

- Apple Podcasts

- Spotify

- Stitcher

- Google Podcasts

- TuneIn

- Deezer

- iHeartRADIO

- PlayerFM

- Listen Notes

- Podcast Addict

Get in touch with us

-

- Connect with us on LinkedIn

- Contact us via Sofeast's contact page

- Subscribe to our YouTube channel

- Prefer Facebook? Check us out on FB

Friday Aug 06, 2021

Four Options For Sourcing From China & Sourcing Best Practices

Friday Aug 06, 2021

Friday Aug 06, 2021

In this episode...

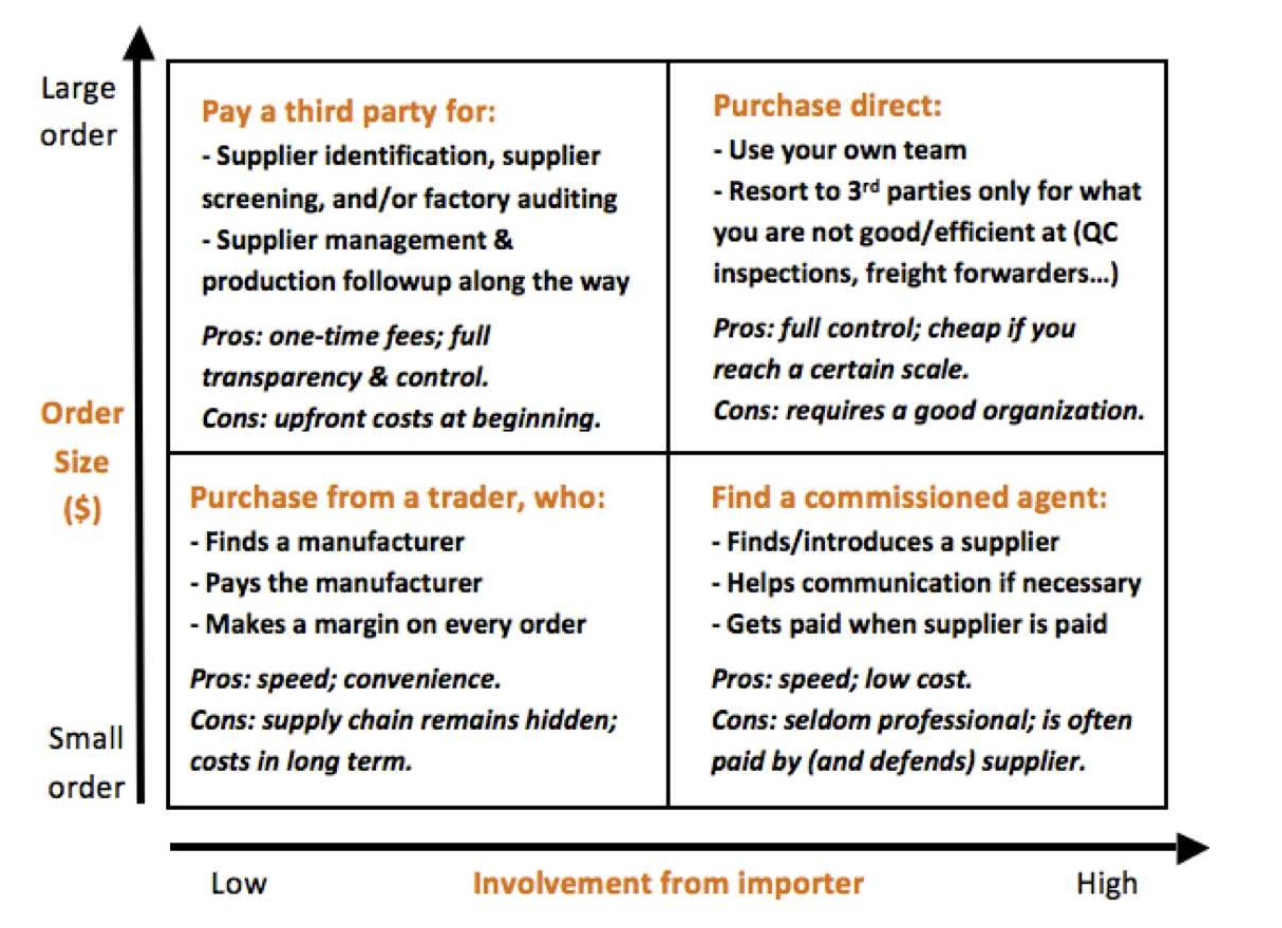

Renaud and Adrian discuss the 4 options open to you when you're sourcing from China, including their pros and cons. Renaud also provides some insight into what exactly it takes to source directly from Chinese manufacturers yourself and shares some best practices for you to consider.

Loosely based on this graphic, they talk about commissioned agents, trading companies, third-party service providers (like us) who provide sourcing as a paid service, and doing it yourself by going direct to manufacturers:

Show Notes

00:00 - Introduction.

01:23 - Is sourcing from China as simple as finding a supplier on Alibaba, Global Sources, etc?

04:28 - The dangers of going for 'the lowest price'

07:57 - What YOU need to be able to commit to if you're sourcing from China yourself

09:24 - If you're planning to source from China, what options do you have? - There are 4 sourcing options: DIY, commissioned agent, trading company, and third-party sourcing company:

12:28 - (1) Commissioned agents

19:46 - (2) Trading companies

27:14 - (3) Third-Party service provider

33:33 - (4) Doing it yourself

34:55 - How to grab a free copy of Sofeast's 80+ page eBook that can help importers start out with sourcing from China

35:20 - Some closing tips from Renaud for better sourcing from China

38:19 - Tackling quality management

39:10 - Wrapping up

Related content...

- Read Sofeast's free eBook: The Ultimate Guide To Sourcing From China And Developing Your Suppliers

- How To Find Trustworthy Suppliers In China In 2021

- Do You Really Need A Sourcing Agent in China Or Can You Do It Yourself?

- How to start buying direct in China

- The terms you need to negotiate with a new supplier

- Sourcing new suppliers (get help from Sofeast)

- Supplier background check (get help from Sofeast)

Get in touch with us

- Connect with us on LinkedIn

- Send us a tweet @sofeast

- Prefer Facebook? Check us out on FB

- Contact us via Sofeast's contact page

- Subscribe to our YouTube channel

Subscribe to the podcast

There are more episodes to come, so remember to subscribe! You can do so in your favorite podcast apps here and don't forget to give us a 5-star rating, please:

- Apple Podcasts

- Spotify

- Stitcher

- Google Podcasts

- TuneIn

- Deezer

- iHeartRADIO

- PlayerFM

- Listen Notes

- Podcast Addict

Get in touch with us

-

- Connect with us on LinkedIn

- Contact us via Sofeast's contact page

- Subscribe to our YouTube channel

- Prefer Facebook? Check us out on FB

Friday Jul 30, 2021

Friday Jul 30, 2021

In this episode...

Renaud Anjoran is joined again by Clive Greenwood, an expert in product compliance for a new episode following on from the first episode they recorded about product compliance (which covered the main compliance challenges faced by importers).

This time they're looking at the future of compliance standards by examining the new Medical Device Regulation (EU) 2017/745 (MDR) which they believe signposts how future regulations will evolve and will definitely heavily impact you if you're a medical device importer and, soon, for many other product types in all likelihood.

So, how much of a change is this regulation and how could it change what you have to go through and provide to get your products certified in future? Let's put it this way, if you're not 100% compliant be afraid as the authorities are going to come for you and now they have teeth!

Show Notes

00:00 - Introduction.

01:54 - Clive introduces himself and what he does.

03:28 - What is the Medical Device Regulation (EU) 2017/745 (MDR) and when did it come into effect?

05:44 - If you import medical devices into the EU and have a CE certificate granted under the old MDD, when do you have to switch and will it be an easy transition?

06:42 - The Scope of the MDR

07:51 - Previously customs found it difficult to check that medical devices were certified, will that still be the case?

12:39 - The MDR requires a LOT more information about your QMS and processes in the technical document pack than just samples passing certification before certification can be achieved.

15:37 - Notified bodies now have to take more action to monitor ongoing production after certification.

16:13 - Who's liable now (post-MDR) if there is any trouble with the products?

20:36 - What happens if it's found that a fake document was submitted or a problem was found?

24:06 - How can companies transition from the old MDD to the new MDR?

30:08 - What if you're planning to bring a medical device to the market soon?

34:43 - Why is the EU MDR beneficial?

36:45 - Wrapping up.

Related content...

- Read the entire Medical Device Regulation (EU) 2017/745 (MDR)

- Compliance testing consulting from Sofeast

- We’re Buying Medical Devices From China And Are Worried Our Supplier Isn’t Legit | Disputes With Chinese Suppliers Q&A (Volume 8)

- Do Sofeast's quality inspectors confirm that the products are fully compliant based on certificates provided by the factory?

- 11 Common Electronic Product Certification And Compliance Requirements

- Why YOU Need a Product Safety Program

- Can Sofeast help us with the certification of our new product?

- What Is Compliance Testing? [Podcast]

- US Compliance Documents When Importing from China: Q&A With an Expert

- Product Compliance 101: What Every Importer Must Know [Q&A]

Get in touch with us

- Connect with us on LinkedIn

- Send us a tweet @sofeast

- Prefer Facebook? Check us out on FB

- Contact us via Sofeast's contact page

- Subscribe to our YouTube channel

Subscribe to the podcast

There are more episodes to come, so remember to subscribe! You can do so in your favorite podcast apps here and don't forget to give us a 5-star rating, please:

- Apple Podcasts

- Spotify

- Stitcher

- Google Podcasts

- TuneIn

- Deezer

- iHeartRADIO

- PlayerFM

- Listen Notes

- Podcast Addict

Get in touch with us

-

- Connect with us on LinkedIn

- Contact us via Sofeast's contact page

- Subscribe to our YouTube channel

- Prefer Facebook? Check us out on FB

Friday Jul 23, 2021

Friday Jul 23, 2021

In this episode...

Rico Ngoma, CEO of Source Find Asia, joins Renaud to share his advice for entrepreneurs and SMEs who want to get started with manufacturing in China.

You'll get loads of great tips such as:

- How to reduce your product development costs

- Steps you can handle yourself to keep costs low

- Steps that you shouldn't skip and should budget for

- How crowdfunding works

- Basic terms you need to agree with your supplier

- ...and much more!

Show Notes

00:14 - Introducing our guest: Rico Ngoma, the CEO of Source Find Asia, a Guangzhou-based sourcing agency.

02:27 - Introduction to Rico's new event, the SourceFinda Asia Digital Summit. The SFA digital summit is a free manufacturing program for entrepreneurs and businesses on a low budget who want to get started with manufacturing that brings together around 16 expert presenters from Rico's network.

*****

05:26 - To echo the SFA digital summit, we'll go through some of the topics that new manufacturers need to understand in this episode.

06:33 - How to develop a new product on a low budget?

11:35 - The stair-step approach to manufacturing.

12:38 - Sourcing & vetting suppliers.

15:20 - Sourcing tips from Renaud and Rico for when on a low budget.

24:01 - What are the basic terms you'll need to set with the supplier you select?

29:12 - The need to take responsibility for your own product approval process.

34:28 - What to do before you start production?

40:26 - Why very technical products aren't a good fit for first-time manufacturers on a tight budget.

42:24 - How adherence to compliance regulations can be expensive.

46:54 - Packaging compliance.

48:26 - Shipping & Logistics.

50:50 - Wrapping up.

Related content...

- Sign up for the SFA digital summit for free!

- Listen to Rico's podcast: Made In China Podcast

- If you are starting to manufacture a new product soon, read our guide: An Importer’s Guide to New Product Manufacturing in China

- Listen to our podcast series on how to vet Chinese suppliers.

- Sofeast's expert team can source great suppliers in Asia or you.

Get in touch with us

- Connect with us on LinkedIn

- Send us a tweet @sofeast

- Prefer Facebook? Check us out on FB

- Contact us via Sofeast's contact page

- Subscribe to our YouTube channel

Subscribe to the podcast

There are more episodes to come, so remember to subscribe! You can do so in your favorite podcast apps here and don't forget to give us a 5-star rating, please:

- Apple Podcasts

- Spotify

- Stitcher

- Google Podcasts

- TuneIn

- Deezer

- iHeartRADIO

- PlayerFM

- Listen Notes

- Podcast Addict

Get in touch with us

-

- Connect with us on LinkedIn

- Contact us via Sofeast's contact page

- Subscribe to our YouTube channel

- Prefer Facebook? Check us out on FB

Friday Jul 16, 2021

Clive Greenwood | 'Made In China' Product Compliance Gaps & Loopholes

Friday Jul 16, 2021

Friday Jul 16, 2021

In this episode...

Renaud Anjoran is joined by Clive Greenwood, an expert in product compliance (amongst other things!) to discuss the issues with compliance that most importers face and some compliance 'loopholes' to be aware of.

This episode raises awareness of compliance because, actually, most people buy products from China without making sure that they are compliant with the laws and regulations of their countries. Why is this, what information are they missing, who is liable for any issues that may occur, and how to improve product compliance? It's all tackled in this episode!

Show Notes

00:14 - Introduction.

01:07 - Clive introduces himself and what he does. Clive brings around 30 years of experience in the manufacturing field to the table, especially with manufacturing compliance, quality, and raising their standards, and is currently CTO at WWMG associates who specialize in standards and compliances to manufacturing industries.

02:07 - Where does the lack of attention to product compliance come from? Is it lack of awareness of the standards, a risk-taking attitude, greed, or all of these cases?

06:38 - Exploring the example of non-compliant respirator masks and other PPE being imported into the West from China in Spring 2020.

15:00 - Why the lack of compliance concern is a combination of the factors mentioned before (naivety, overtrust, greed, pressure, etc).

19:17 - Do the customs in the EU still check the documentation of medical devices such as PPE being imported?

21:53 - Let's say you set up a company and import consumer products into the EU or USA. Who checks that your products are compliant?

26:16 - What is the main loophole with compliance these days?

28:45 - Who has liability for any products that have a fault that causes danger or damage to people or property?

35:38 - Wrapping up.

This episode is going to be followed up soon with another about how compliance standards are evolving. 👌

Related content...

- Compliance testing consulting from Sofeast

- We’re Buying Medical Devices From China And Are Worried Our Supplier Isn’t Legit | Disputes With Chinese Suppliers Q&A (Volume 8)

- Do Sofeast's quality inspectors confirm that the products are fully compliant based on certificates provided by the factory?

- 11 Common Electronic Product Certification And Compliance Requirements

- Why YOU Need a Product Safety Program

- Can Sofeast help us with the certification of our new product?

- What Is Compliance Testing? [Podcast]

- US Compliance Documents When Importing from China: Q&A With an Expert

- Product Compliance 101: What Every Importer Must Know [Q&A]

Get in touch with us

- Connect with us on LinkedIn

- Send us a tweet @sofeast

- Prefer Facebook? Check us out on FB

- Contact us via Sofeast's contact page

- Subscribe to our YouTube channel

Subscribe to the podcast

There are more episodes to come, so remember to subscribe! You can do so in your favorite podcast apps here and don't forget to give us a 5-star rating, please:

- Apple Podcasts

- Spotify

- Stitcher

- Google Podcasts

- TuneIn

- Deezer

- iHeartRADIO

- PlayerFM

- Listen Notes

- Podcast Addict

Get in touch with us

-

- Connect with us on LinkedIn

- Contact us via Sofeast's contact page

- Subscribe to our YouTube channel

- Prefer Facebook? Check us out on FB